What are the Benefits of the Portugal D2 Visa ?

The Portugal D2 Visa allows you to enter Portugal and the Schengen area (26 EU countries). You can circulate freely without a visa. The D2 visa essentially grants you the travel rights of all European Union citizens. This is perfect for entrepreneurs who want to travel through Europe to network and build corporate connections.

You don’t need to leave your family behind with the D2 Visa. This visa allows for family reunification where your family members are granted the same residency rights as you. This means that a partner, children under 18, dependent children over 18 that are studying, parents, and minor siblings. From getting permanent residence to tax incentives, family reunification grants all the same rights to your family. You will have to prove your relationship to any family members included in the program.

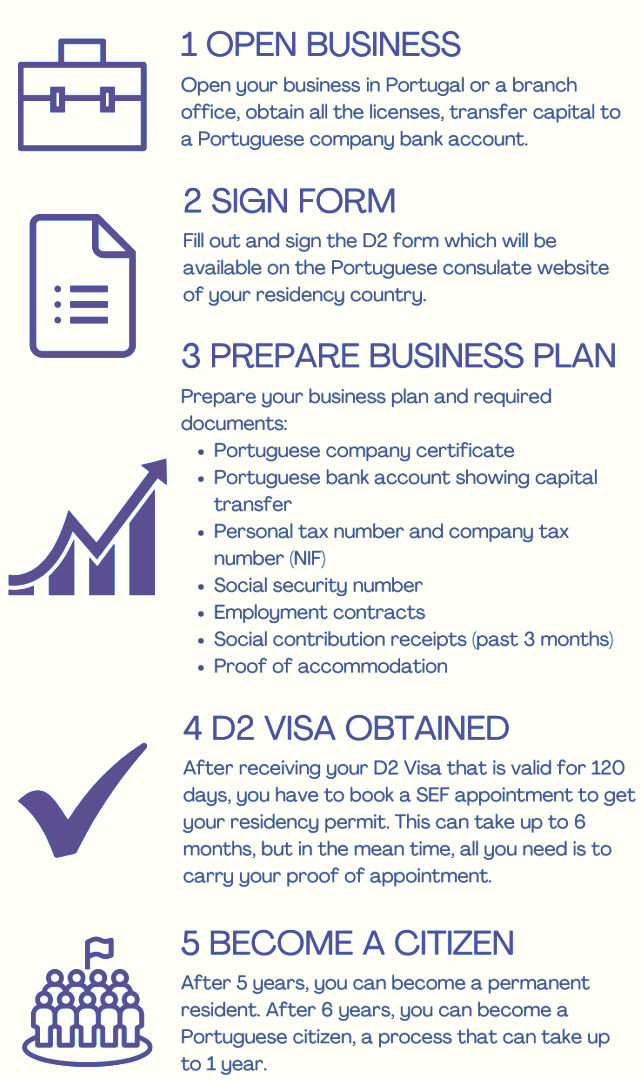

Yes! Right after receiving your D2 Visa, you have to book an appointment with the Foreigners and Borders Service (SEF) to obtain a residency permit. Your D2 Visa is only valid for 120 days, but if you carry proof that you have booked this appointment, you are good to go. You will renew your residency until the 5-year mark when you can apply for permanent residency.

You can become a Portuguese citizen after 6 years of legal residency. To do so, you need to learn Portuguese and obtain an A2 Portuguese language certificate, have a clean criminal record, and provide documents such as proof of a Portuguese bank account.

With a Portugal Golden Visa, Portugal D7 Visa, and Portugal D2 Visa, you can become a non-habitual resident (NHR) and enjoy the incentives of this fiscal regime. This tax regime allows you to transfer your tax residency to the country. To be eligible, you cannot have been taxed in Portugal during the five years before the application.However, this does not apply to corporate tax.

Here are the benefits of this tax regime:

- You can be eligible to not pay ANY tax on pensions, rental income, real estate gains, and income from non-Portuguese sources if your country has a Double Taxation Agreement (DTA) with Portugal. You would instead pay taxes in your country of origin. The UK, USA, and many more countries have a DTA with Portugal where this is the case.

- If your pension income is taxed in Portugal, it will be at a flat rate of 10%, including retirement savings and insurance.

- Income from “high value-added activities” in Portugal is taxed at 20%. This includes employment and self-employment income from activities of scientific, artistic, or technical character performed in Portugal. Still, you will pay the same income tax as ordinary tax residents for other types of domestic income.

- You will only be taxed on your worldwide income after the first 10 years of residence.

- Foreign interest, dividends, rents, and property capital gains can be exempted from taxation.

- You will not pay an inheritance or wealth tax.

Corporate Tax & Social Security Tax in Portugal

HOWEVER, this will apply to you as a resident, but not a registered company and you will have to pay the regular corporate tax (IRC) in Portugal. The corporate tax in the Portuguese mainland is 21%, while the first €25,000 of taxable profit for small and medium-sized companies is taxed at 17%. The corporate tax rate is lower for Madeira (20%) and the Azores (16.8%). You will also need to pay the social security tax (TSU) for your employees when you pay their salary. Companies pay 23.75% TSU for each monthly wage, while an extra 11% comes directly from the employee’s salary. Therefore, for a €2,000 monthly salary, your company will pay €475 a month for social security, while the employee will pay €220.

Apply D2 Visa